!function(r,u,m,b,l,e){r._Rumble=b,r[b]||(r[b]=function(){(r[b]._=r[b]._||[]).push(arguments);if(r[b]._.length==1){l=u.createElement(m),e=u.getElementsByTagName(m)[0],l.async=1,l.src="https://rumble.com/embedJS/u4"+(arguments[1].video?'.'+arguments[1].video:'')+"/?url="+encodeURIComponent(location.href)+"&args="+encodeURIComponent(JSON.stringify([].slice.apply(arguments))),e.parentNode.insertBefore(l,e)}})}(window, document, "script", "Rumble");

Rumble("play", {"video":"v6tbbed","div":"rumble_v6tbbed"});

Pet insurance is a topic that often overwhelms new and even experienced pet owners alike. Navigating the myriad options, understanding coverage nuances, and selecting the right plan can feel daunting. Drawing from extensive experience and insights shared by experts in the pet insurance community, this guide delves deep into everything you need to know about pet insurance.

Whether you’re considering insurance for a new puppy or managing coverage for a dog with preexisting conditions, this article will help you make informed decisions to protect your furry family members.

Table of Contents

- Introduction: Why Pet Insurance Matters

- Getting Started: Understanding Pet Insurance Basics

- Key Considerations When Choosing Pet Insurance

- Financial Planning and Premium Considerations

- Pet Insurance and Preexisting Conditions

- Claims Process and Vet Billing

- Real-Life Experiences: Why Pet Insurance Matters

- Frequently Asked Questions (FAQ)

- Conclusion: Making the Best Choice for Your Pet’s Health

Introduction: Why Pet Insurance Matters

Many pet owners don’t anticipate their dogs becoming seriously ill or needing expensive medical care when they first bring them home. However, as many heart dog owners and rescue volunteers have learned, unexpected health issues can arise at any time. The financial burden of veterinary care, especially for conditions like heart disease, cancer, or emergency surgeries, can quickly become overwhelming.

Pet insurance offers peace of mind, ensuring that when your dog needs care, money is not the deciding factor. It allows you to focus on your pet’s health without the stress of exorbitant vet bills. This guide is informed by years of experience from dedicated pet insurance advocates, including Michelle Lawson Fairfield from Mighty Hearts Project and Naheed Carmali, an admin at Pet Insurance Info Exchange. Together, they have compiled crucial information to help you navigate pet insurance confidently.

Getting Started: Understanding Pet Insurance Basics

One of the first challenges when looking for pet insurance is knowing where to begin. The market is flooded with companies, plans, and terms that can confuse even the most diligent pet parent. Here’s a step-by-step approach to help you get started:

1. Choose an Established Company

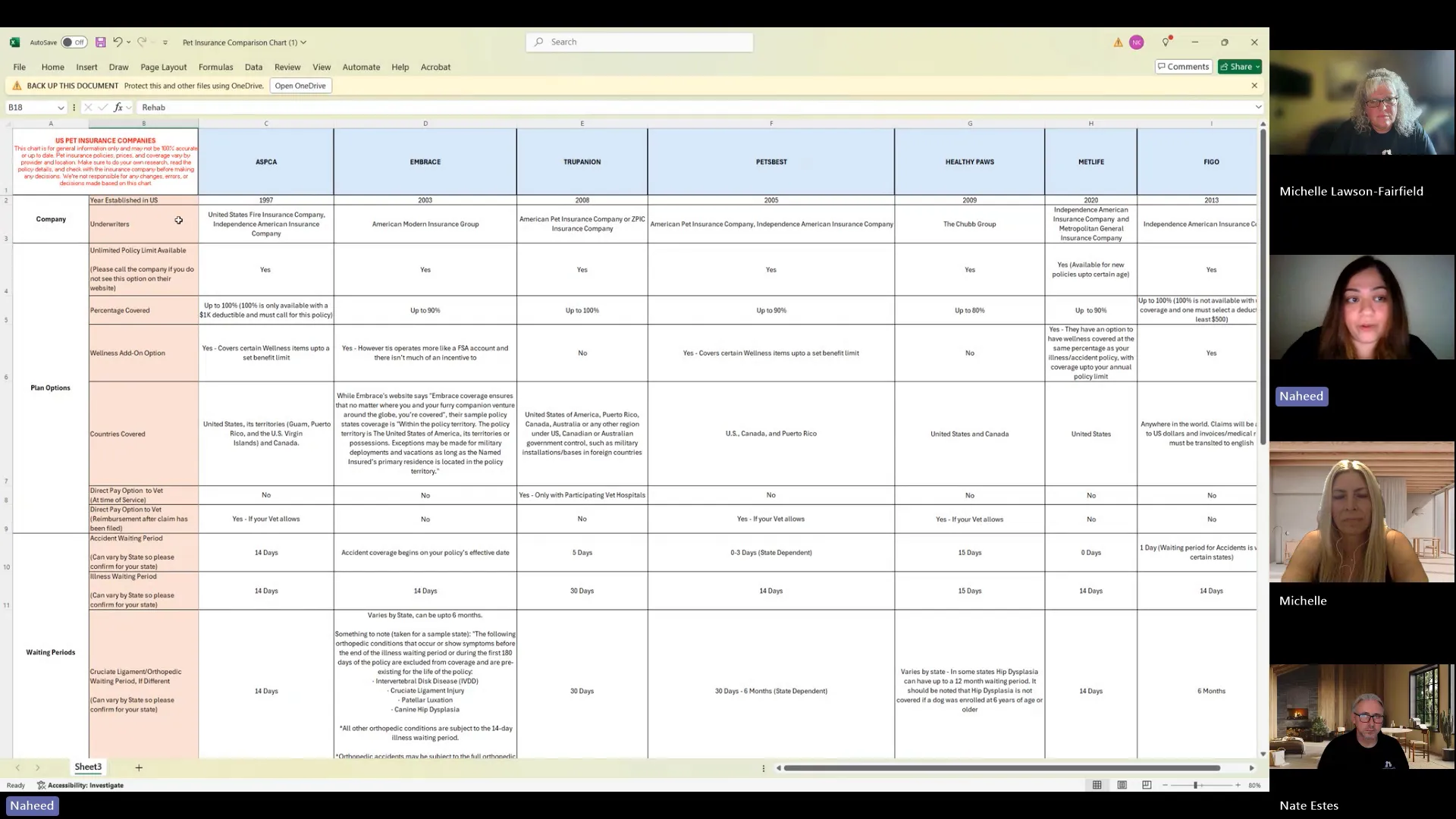

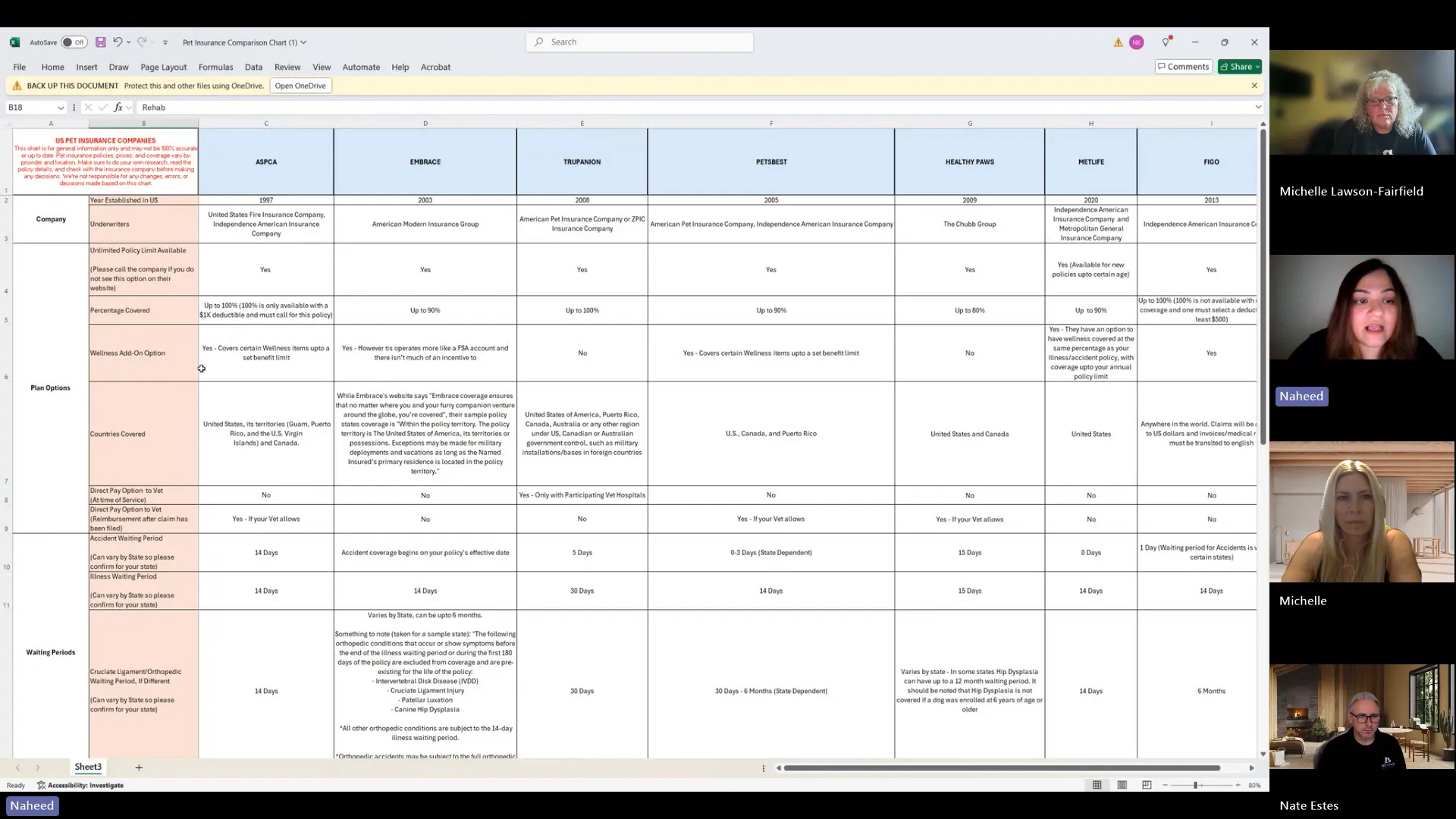

When selecting a pet insurance provider, it’s wise to prioritize companies with a long-standing presence in the industry. Established companies have a track record, making it easier to assess their reliability and customer service.

For example:

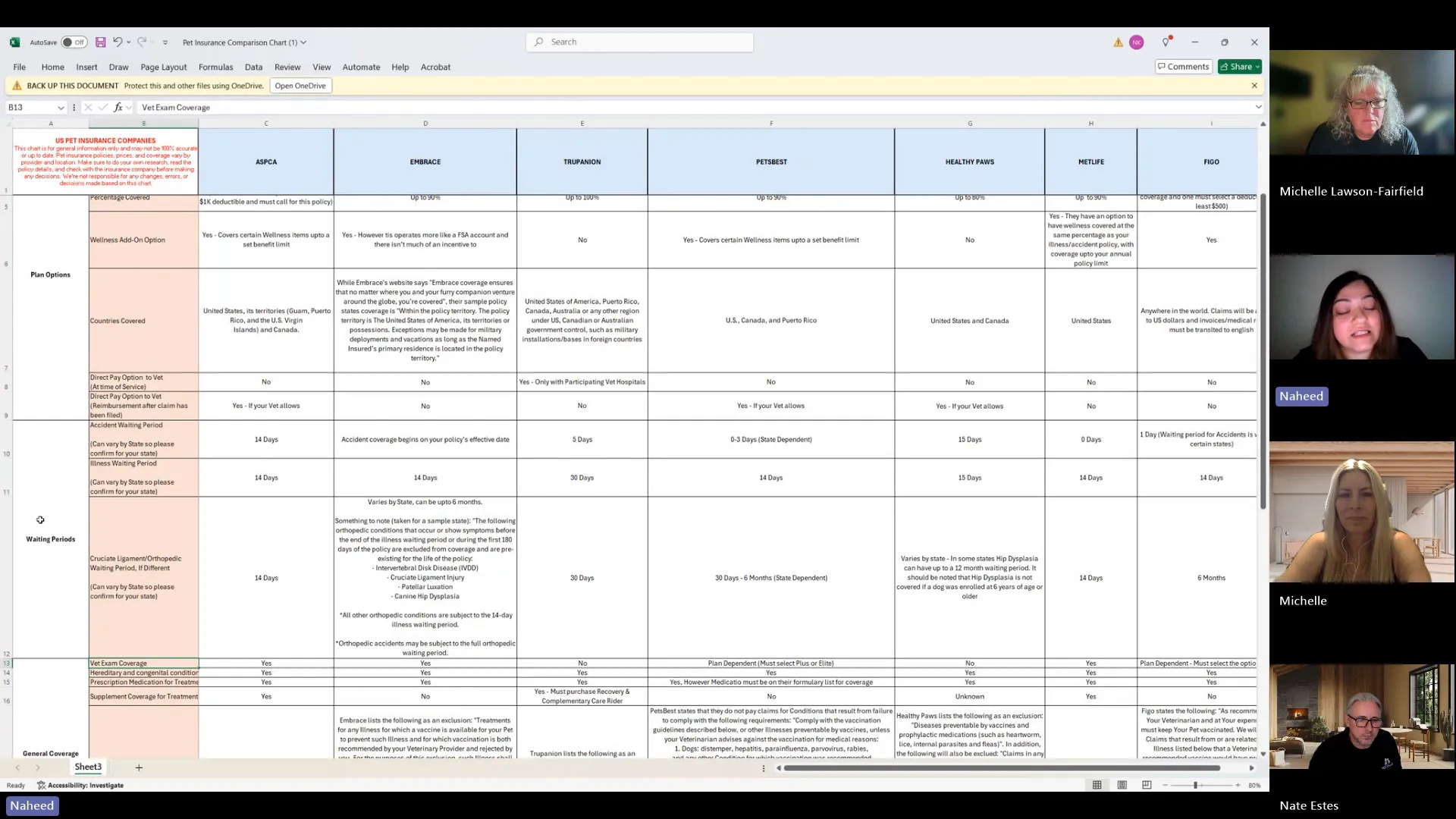

- ASPCA Pet Insurance was established in 1997.

- Trupanion has been around since 2008.

- Embrace and MetLife are newer players, with MetLife entering the market around 2020.

Newer companies may offer attractive policies or lower premiums, but there is a risk they might change terms abruptly, get acquired, or exit the market, leaving you without coverage. Always verify the company’s history and reputation before committing.

2. Understand Underwriters and Policy Similarities

Many pet insurance companies share the same underwriters, which means their policies might have similar terms and conditions. For instance, if you notice that your ASPCA policy resembles another company’s, it could be because they are backed by the same underwriter. This knowledge can help you compare plans more effectively.

3. Policy Limits: Why Unlimited Coverage is Preferable

When obtaining a quote, you will be asked about the policy limit or maximum payout per year. Options often range from $10,000 to unlimited. While $10,000 might seem sufficient, it can quickly be exhausted with specialist visits, emergency care, or surgeries.

Choosing unlimited coverage is ideal, especially for breeds prone to chronic or expensive health issues. Importantly, if you start with a lower limit and later want to increase it, you will likely have to start a new policy. This new policy will treat existing conditions as preexisting, leaving them uncovered. Conversely, you can usually decrease your policy limit without penalty.

Tip: Always opt for the highest policy limit you can afford initially to avoid gaps in coverage later.

4. Percentage of Coverage: Balancing Budget and Protection

Pet insurance plans typically cover between 70% and 100% of eligible veterinary expenses after deductibles. Higher coverage percentages reduce out-of-pocket costs but increase monthly premiums.

Consider your financial situation when choosing your coverage level. If you prefer minimal out-of-pocket expenses during claims, aim for 90% or 100% coverage. Those comfortable with some expense sharing might opt for 70% or 80% plans.

5. Wellness Add-Ons: Are They Worth It?

Wellness coverage includes routine care like vaccinations, flea prevention, and dental cleanings. Most pet insurance policies focus on accidents and illnesses, not wellness. If you want wellness coverage, check if the insurer offers it as an add-on and what the limits are.

For example, MetLife offers wellness coverage at the same reimbursement percentage as their illness and accident plan, which can be advantageous if you regularly invest in wellness care. Others may cap wellness reimbursements at modest amounts, making it less cost-effective.

Key Considerations When Choosing Pet Insurance

1. Waiting Periods

Waiting periods are the time frames after purchasing insurance during which claims for certain conditions are not covered. These periods vary by insurer and condition type:

- Accidents: Often the shortest waiting period (e.g., 5 to 14 days).

- Illnesses: Typically longer, around 14 to 30 days.

- Orthopedic conditions: Can have extended waiting periods, sometimes up to six months.

Some companies offer orthopedic waivers requiring your veterinarian to certify the absence of orthopedic issues at sign-up. While this may shorten waiting periods, it can backfire if the vet discovers asymptomatic conditions, which then become preexisting and excluded.

Advice: Review waiting periods carefully, especially for orthopedic coverage, and consider how they align with your dog’s health and lifestyle.

2. Vet Exam Coverage

Not all pet insurance policies reimburse vet exam fees, which can add up considerably, especially at specialists or emergency clinics.

For example:

- ASPCA, Embrace, and MetLife include exam coverage.

- Trupanion does not cover exams.

- Pets Best offers exam coverage only on higher-tier plans.

- Healthy Paws generally does not cover exams.

Billing practices also affect reimbursements. Some clinics bundle multiple services into one charge, which can lead to claim denials if the insurer can’t distinguish exam fees from other procedures.

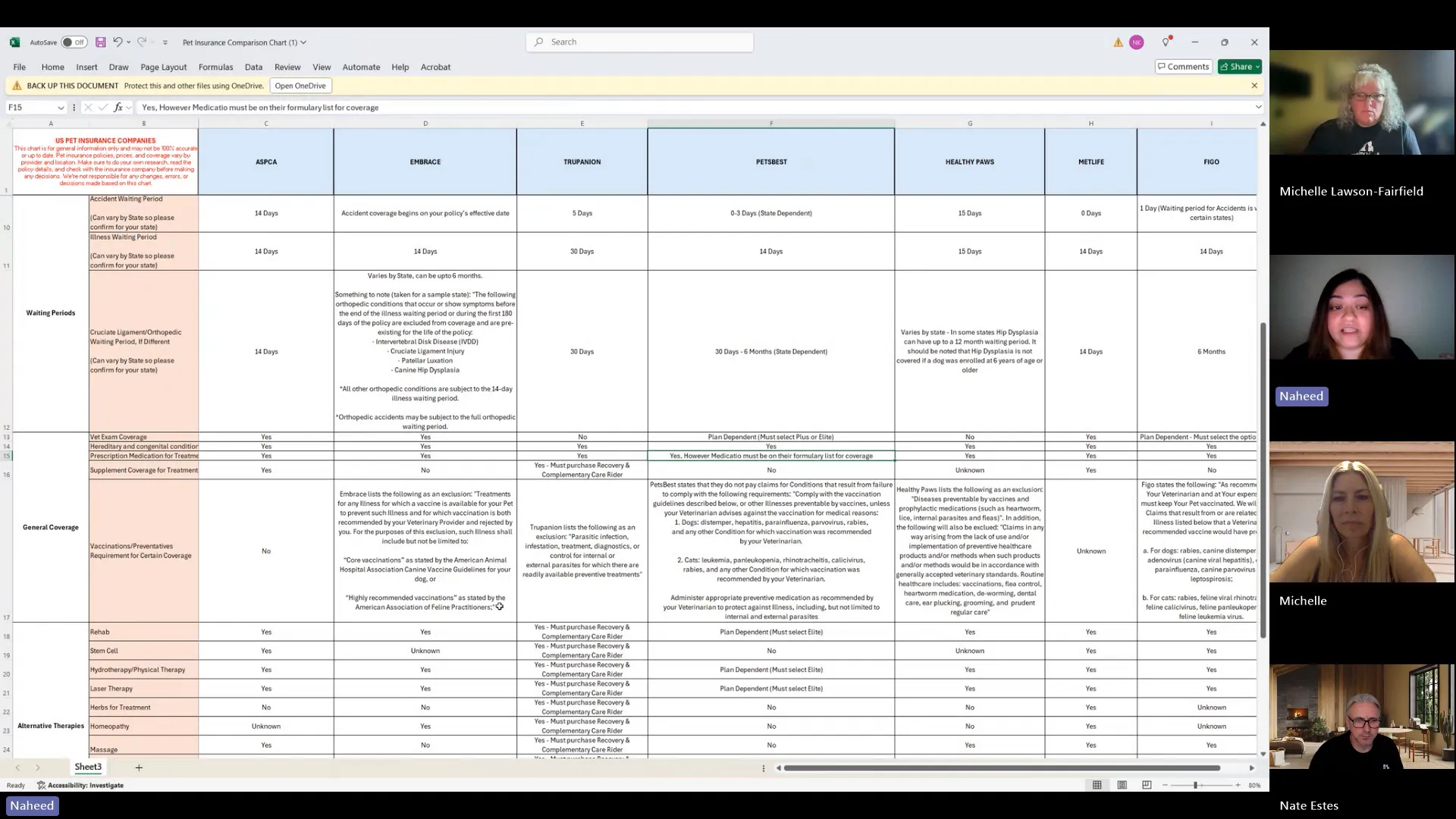

3. Prescription Medications and Supplements

Most pet insurance plans cover prescription medications related to covered conditions, but some have restrictions:

- Pets Best requires medications to be on their formulary list.

- Other insurers have fewer restrictions.

Supplement coverage varies significantly. Some companies cover supplements prescribed for treatment, while others exclude them. Trupanion offers supplement coverage only if you purchase an additional recovery and complementary care rider.

4. Vaccination and Preventative Requirements

Many pet insurance companies require pets to be vaccinated and receive preventative treatments to qualify for certain coverage. Failure to comply may lead to claim denials, especially for conditions preventable by vaccines or parasite control.

However, exceptions often exist if your veterinarian advises against specific vaccinations for medical reasons. Always keep thorough veterinary records and communicate with your insurer if you deviate from standard protocols.

Important: Some policies include clauses regarding neglect, where failure to provide preventative care might be interpreted as neglect and result in claim denial or policy cancellation.

5. Alternative and Complementary Therapies

Alternative therapies such as rehabilitation, stem cell therapy, hydrotherapy, laser therapy, acupuncture, and chiropractic care are increasingly popular but vary widely in coverage.

Coverage depends on the insurer and often requires that therapies be supervised or administered by a licensed veterinarian. Some examples include:

- ASPCA covers most alternative therapies except herbs.

- Trupanion covers these only if you purchase a special rider.

- Pets Best covers some therapies only on their highest-tier plans.

- Healthy Paws and MetLife offer broader coverage.

Costs for these therapies can be significant, sometimes hundreds of dollars per session, especially if administered weekly. For dogs prone to orthopedic issues or recovering from surgery, these therapies can be invaluable.

6. Dental Coverage

Dental care, especially for dental illnesses, is a common concern for pet owners. Professional dental cleanings can cost thousands of dollars, particularly when involving specialists and anesthesia.

Coverage varies:

- ASPCA covers dental illnesses and extractions but excludes root canals and crowns.

- MetLife covers dental illnesses under illness coverage and wellness add-ons.

- Healthy Paws generally does not cover dental illnesses.

- Pets Best requires regular cleanings to maintain coverage.

Preventative cleanings without illness usually fall under wellness plans, which have limited caps.

7. Geographic Coverage

Most pet insurance plans cover veterinary care within the United States, with many extending coverage to Canada. Few cover international care comprehensively.

Figo Pet Insurance stands out by offering worldwide coverage, including the UK and other countries, with the caveat that bills and records must be in English and costs adjusted to U.S. dollars.

Traveling with your pet outside the covered regions may result in paying out-of-pocket for veterinary care, even if you have insurance.

Financial Planning and Premium Considerations

1. Deductibles and Premiums

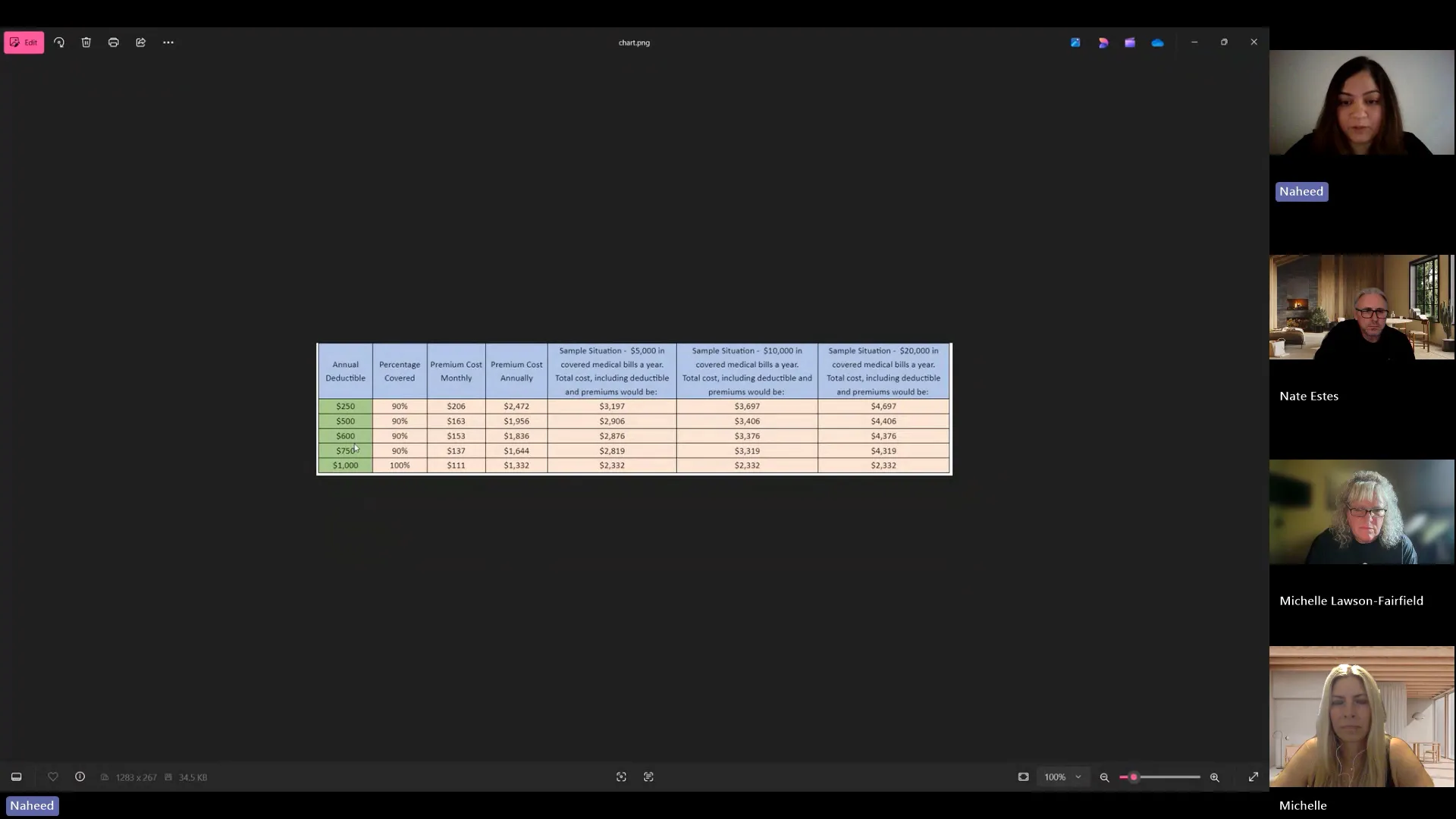

Pet insurance deductibles are typically annual, meaning you pay the deductible once per policy year. Trupanion is unique in offering a per-incident lifetime deductible, which has its pros and cons.

Lower deductibles result in higher premiums but reduce out-of-pocket costs when making claims. Higher deductibles lower premiums but require more upfront payment if your pet needs care.

Using a hypothetical example, a $250 deductible with 90% coverage might cost $206 per month in premiums for an older dog, totaling nearly $2,500 annually without claims. If the dog incurs $5,000 in vet bills, total costs (premiums plus out-of-pocket) could exceed $3,200.

Alternatively, a $1,000 deductible with 100% coverage might cost less in premiums, and after paying the deductible, no further costs would be due, potentially saving money if your pet requires significant care.

Advice: Use online calculators or spreadsheets to compare different deductible and coverage combinations to find the best financial fit for your situation.

2. Additional Discounts and Benefits

Many insurers offer discounts that can reduce your premiums, including:

- Rescue or shelter volunteer discounts.

- Military discounts.

- Membership-based discounts, such as through Costco or other organizations.

Always call the insurer directly to ask about available discounts, as some options may not be visible online.

Pet Insurance and Preexisting Conditions

One of the most challenging aspects of pet insurance is coverage for preexisting conditions. Most companies exclude conditions diagnosed before policy enrollment.

For dogs already diagnosed with heart disease or murmurs, options are limited. The American Kennel Club (AKC) offers some coverage for preexisting conditions after 365 days of continuous coverage but caps payouts at $10,000 annually.

Employer-sponsored insurance plans through companies like MetLife may cover preexisting conditions if you switch plans while already insured and the previous insurer covered those conditions. However, this is contingent on continuous coverage and employer plan eligibility.

Key takeaway: If your dog has preexisting conditions, carefully research policies and consult insurers to understand coverage limits and waiting periods.

Claims Process and Vet Billing

Understanding how claims are paid is crucial for managing finances during veterinary visits.

- Direct Pay: Trupanion offers direct pay to participating vets, meaning the vet bills the insurer directly, and you only pay your portion at checkout.

- Reimbursement: Most insurers require you to pay upfront and then submit claims for reimbursement. The vet must accept this arrangement, which not all do.

Ensure your primary vet and any emergency or specialty clinics accept your insurance plan, especially if direct pay is important to you.

Real-Life Experiences: Why Pet Insurance Matters

Heart dog owners and rescue community members often share stories illustrating the critical role of pet insurance:

“I never want money to be the reason between life or death. With pet insurance, you have peace of mind to go to the emergency room and get the best care possible.” – Naheed Carmali

“We popped $10,000 on one dog for her to die three days later. Pet insurance gives you peace of mind so you’re not forced to make heartbreaking decisions due to finances.” – Michelle Lawson Fairfield

These insights highlight the emotional and financial relief that pet insurance can provide during emergencies and chronic illness management.

Frequently Asked Questions (FAQ)

Q1: Can I get pet insurance for a dog with preexisting conditions?

Most pet insurance companies exclude preexisting conditions. However, some, like AKC, may cover them after a 365-day waiting period with continuous coverage. Employer-sponsored plans might cover preexisting conditions if you switch from an existing policy under certain conditions.

Q2: Is unlimited coverage always better than a set limit?

Unlimited coverage protects you from unexpectedly high veterinary bills, especially for emergency or specialist care. While it typically costs more, it provides greater financial security. Setting a limit may save money upfront but can leave you exposed to high out-of-pocket costs if bills exceed the cap.

Q3: Do pet insurance policies cover routine vet visits and vaccinations?

Most policies focus on accidents and illnesses. Wellness plans or add-ons may cover routine care like vaccinations, dental cleanings, and flea prevention, but these often have annual caps. Some companies, like MetLife, offer wellness coverage at the same reimbursement level as illness coverage.

Q4: How do waiting periods affect my coverage?

Waiting periods are time frames after enrollment during which specific types of claims are not covered. They vary by insurer and condition type. Accident waiting periods are usually shorter than illness or orthopedic waiting periods. It’s important to review these carefully before purchasing.

Q5: Can I increase my policy limit after signing up?

Generally, increasing your policy limit requires starting a new policy, which treats existing conditions as preexisting and excludes them from coverage. You can usually decrease your coverage amount at renewal without penalty, but increasing it often has limitations.

Q6: Does pet insurance cover alternative therapies like acupuncture or physical therapy?

Coverage for alternative therapies varies widely. Some insurers cover these therapies fully or as add-ons, while others exclude them. Check the fine print and whether therapies must be administered under veterinary supervision to qualify for coverage.

Q7: Will my pet insurance cover veterinary care outside the US?

Most pet insurance plans cover care within the US and sometimes Canada. Few, like Figo, offer worldwide coverage, but claims must meet specific requirements like English documentation and currency conversion. Always verify geographic coverage before traveling internationally with your pet.

Conclusion: Making the Best Choice for Your Pet’s Health

Choosing pet insurance is a significant step toward safeguarding your pet’s health and your financial well-being. With numerous companies and plans available, it’s essential to research thoroughly, understand policy terms, and consider your pet’s unique health risks and your budget.

Start by selecting an established insurer, opt for the highest policy limits you can afford, and consider coverage percentages carefully. Pay attention to waiting periods, vet exam coverage, prescription and supplement policies, and wellness add-ons. Always verify if your preferred veterinarians accept your chosen insurance and understand the claims process.

Remember, pet insurance is not just a financial product; it’s a tool for peace of mind, enabling you to provide your pet with the best possible care without the stress of unexpected costs. As pet healthcare advances and veterinary costs rise, having comprehensive pet insurance becomes increasingly important.

Stay informed, read policy documents carefully, and don’t hesitate to call insurance providers to clarify details or ask about discounts. Your diligence today will pay dividends in the health and happiness of your beloved pet tomorrow.